Is Your AP Process Secure? 4 Best Practices for B2B Payments

Can your accounts payable transactions be classified as business-to-business (B2B) payments? The answer is yes. Your vendors or suppliers run businesses of their own and your invoice payments fall under the B2B category. With that out of the way, B2B payments hit the $113 trillion mark in 2023 and it is expected to continue increasing as the years go by. However, conducting $113 trillion worth of transactions does not occur without hitches. 65% of businesses experienced financial-related fraud in 2023.

The aforementioned statistics show that with increasing B2B transactions comes the need to implement secure processes to eliminate fraud. However, it is important to note that today’s focus is on the best practices for implementing your accounts payable process. Hence, it is only right to highlight the other challenges businesses face with fulfilling invoices aside from fraud.

Challenges with the Accounts Payable Process

- Manual Data Entry – How do you receive your invoices? Through the post or via email? Most SMBs experience a bit of both due to the preferences of their vendors. If your business falls within this category, then you understand the challenges associated with searching for your purchase orders, reconciling accounts, and making payments using pen and paper.

The process of collating invoices by hand or manually is labor-intensive and prone to error. The possibility that a vendor’s invoice may be left out while making payments is also high.

- Keeping Track of Invoices – Physical invoices are easy to lose regardless of how careful you are with storing financial records. Once an invoice is lost, you are likely to forget about it or have to call the vendor to resend another copy. In a scenario where you forget to make payment, this could harm your business relationship with your vendors. It could also be seen as a red flag by potential investors.

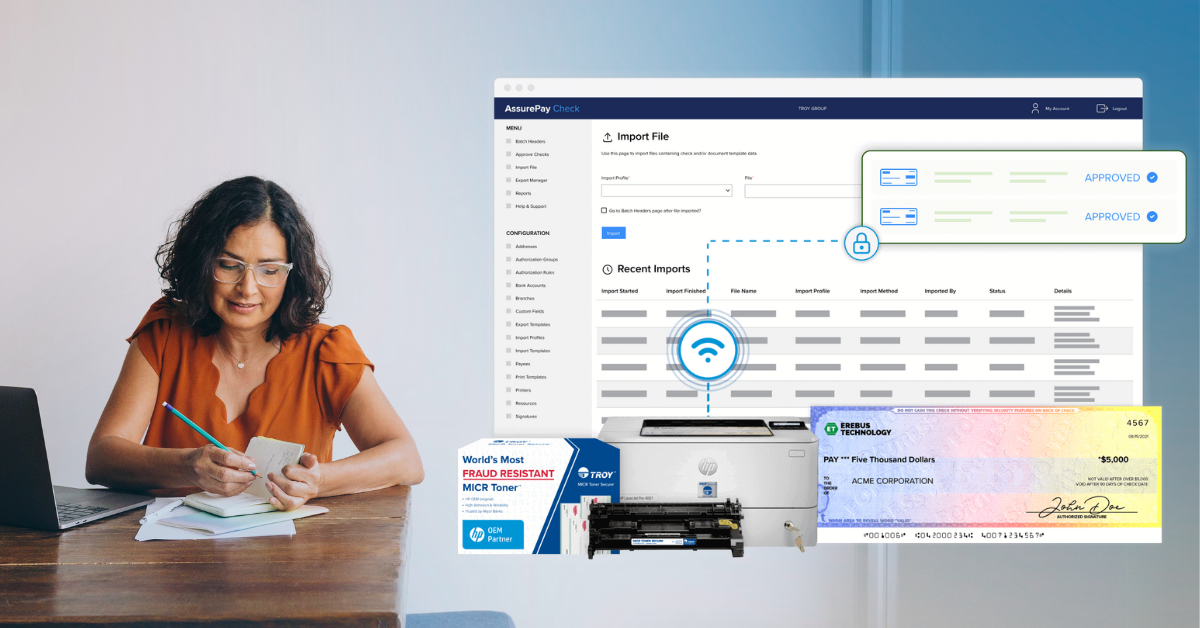

- Fraud Security – Just like keeping track of your vendors’ invoices is crucial to the account payable process, actively protecting from fraud is just as important. With the large number of checks printed using outdated accounts payable software, its important to be protecting your account information by printing to blank check stock, while using the most updated software, so there is less risk in cases of check theft, check washing, or software hacking.

4 Best Practices to Secure and Optimize Your Accounts Payable Process

- Address Pain Points with Technology – Which of the above challenges does your business struggle with? If it's one of the above or a combination of them, digitally transforming your accounts payable processes will ease most of your challenges. Here, digital transformation solutions refer to accounts payable software with the capability to capture your invoices within a centralized dashboard. Centralization solves your data collation challenges, reduces the chance of forgetting invoices or purchase orders, and simplifies the accounts reconciliation process. You could also choose to leverage technology to enhance and secure your payment processes. Payment processes such as ACH, ETF, or checks provide you with options to meet your vendors’ specific requirements.

- Integrate Accounts Payable Solutions with Accounting Software – Accounting software such as QuickBooks are excellent financial data-capturing tools that enable you to keep updated records. However, they are designed to support a diverse range of financial processes such as payrolls, creating financial statements, paying taxes etc. but have limited features to streamline the accounts payable process. Sure, they can store your vendor details, invoices or purchase orders but you would need an accounts payable software for reconciliation, analysis, and payment. Hence, choosing an account payable that integrates with your accounting software will help streamline your vendor payment processes. You can learn how to make the right choice using this checklist.

- Quantify the Benefits of Investing in Technology – This best practice is targeted at accountants, the accounting department, and any employees in charge of accounts payable who must report progress to decision-makers. Your ability to quantify the ROI from using an accounts payable software will ensure its continued support from your stakeholders. The benefits to look out for include both tangible and intangible advantages. Ensure to showcase how it reduces the man-hours spent managing the accounts payable process, eliminates errors, automates account reconciliation, optimizes calculations, and optimizes the business’s relationship with vendors.

- Get everyone on Board – Decision-makers who introduce the use of accounts payable solutions to a business also have their responsibilities. These responsibilities include convincing employees or accountants that the use of accounts payable software will ease these activities allowing them to focus on other things. Successfully integrating accounts payable software is an investment that brings recurring returns.

Taking the Next Steps

Without an accounts payable software, your business cannot implement these best practices and leverage the benefits of digitalization and automation. So, the final step to optimizing accounts payable begins with deploying one to ease your business challenges. TROY FlexPay is a turnkey accounts payable software built with the tools and features to resolve your pain points. Sign up at no cost or request a demo here.

Related Posts

Upgrading Your Banking Core: Where to Start

Banking is facing a scary shift. While neobanks, FinTech app, P2P payment services and more digital transaction platforms become more popular, traditional banks and credit unions..

Compare MICR Printers: Choosing The Best Option For Your Business

When it comes to professional & business check printing, choosing the best MICR printer is crucial for security, accuracy, and efficiency. Whether you're a small business owner or..

How To Print Checks From Home - What You'll Need

If you're a small business owner or even an accounting professional, you may have been tasked to work in a place other than your office building within the last few years. In..

Leave a Reply