Should You Use Preprinted or Blank Check Stock? - Check Printing

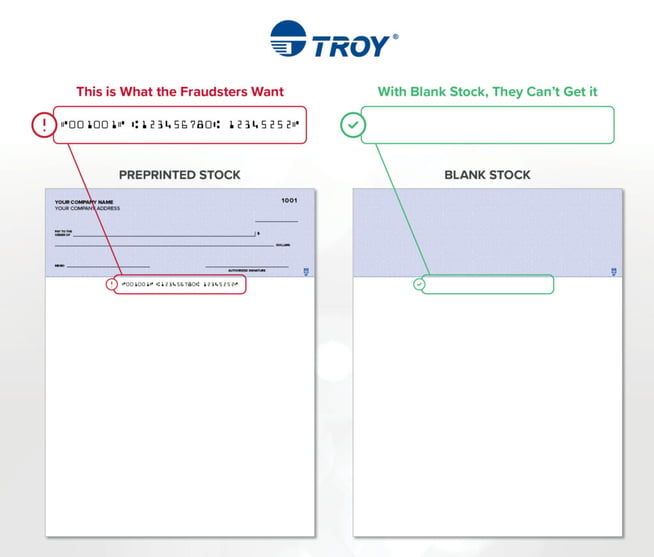

Due to the fraud risks associated with preprinted check stock, we highly encourage the use of blank check stock. Switching from pre-printed to blank check stock in your check printing process is a simple first step in reducing your organizations risk of check fraud. While preprinted stock arrives with banking details already on it (making it a theft risk!), blank stock comes completely blank. This enables you to print all the check data and the MICR line at the time of issuance. It is the most fundamental and economical way for an organization to reduce the risk of fraud. It also increases the efficiency of your check printing workflow.reduce the risk of fraud.

The Advantages of Fraud-Resistant Blank Check Stock

With check fraud on the rise and showing no signs of stopping, using preprinted check stock puts organizations at risk. Because the bank routing and account numbers are already printed, this stock is a high-value target. Using preprinted stock exposes businesses to theft, alteration, and forgery. Not only that, it is costly and inefficient.

Because blank check stock comes completely blank, all of the check’s variable data, static data, and MICR line can be printed at the time of issuance. It also reduces the risk of duplicate checks in the event of a paper jam, and eliminates the need for separate, secure storage. By implementing blank check stock into their process, organizations no longer need to worry about the financial and labor costs associated with buying, storing, distributing, and tracking preprinted stock.

Read our newest whitepaper to learn the risks associated with preprinted check stock, and why it is beneficial for your organization to implement blank check stock into the check printing process.

Related Posts

Bank Tellers Are Going Away. What's Next?

The landscape of banking has undergone significant transformation. One notable shift is the steady decline in bank teller jobs, a trend driven by technological advancements,..

Platform Revolution: 4th Generation of Core Banking

The 4th generation of core banking has arrived, bringing with it a platform revolution that is reshaping the banking industry. This transformation heralds the transition from..

5 ATM Features Banks Need in a Cashless Society

As contactless payments, digital wallets, and online banking increasingly become the norm, the reliance on cash is steadily diminishing. This shift towards a cashless society is..

Leave a Reply