5 Ways TROY FlexPay Simplifies Your Accounts Payable Processes

Do you know what accounts payable is? Maybe you've heard of it and know the general gist, but lets go a bit deeper. Accounts payable is the amount you owe your vendors for the items and services they provided on credit or according to a specified payment plan. As expected, not fulfilling the terms of this credit agreement or payment plan comes with specific consequences such as the loss of credibility with your suppliers or losing funds by overpaying.

Now that the definition is out of the way, here comes the important part. Approximately 82% of small and mid-sized businesses fail within their first 5 years, and struggling with accounts payable could be the culprit. For large businesses, a multitude of accounts payable data and human error are the leading causes of their challenges. SMBs also face similar challenges and this is what today’s blog is about.

Challenges SMBs face with Accounts Payable

Manual Data Entry: Firstly, it is worth stating that vendors or suppliers do not always cooperate with your preferred choices for receiving invoices. Some vendors may send invoices through the mail, others through your marketing email, and a few invoices to company representatives they’re comfortable with. Hence, collating these invoices and the data within them is challenging. Manual data entry processes require searching through tons of mail, both physical and digital, to execute the required calculations before making payments. The manual process is prone to human errors and is labor intensive which as you probably know, leads to multiple errors. Manual data entry also takes a lot of man-hours from employees who should be spending their working hours on core business functions.

Keeping Track of Invoices: Losing track of a single invoice is an easy mistake to make. But, when misplacing multiple invoices becomes a regular occurrence, then it’s probably time to stop the tide. While it is easier to notice a singular invoice and request another from a singular vendor, loosing multiple invoices increases the probability that a few might fall through the cracks. Receiving the dreaded ‘follow-up’ call from multiple suppliers may highlight the end of a few supplier–recipient relationships. This is of course bad for your business and may negatively affect your audit readiness.

Tracking Purchase Orders: Just like keeping track of your vendors’ invoices is crucial to the account payable process, accurately generating and tracking purchase orders is also important. Purchase orders allow you to keep track of the items you have purchased, the cost of the purchase, and when payment should be made. They also bring order to a world of chaos when you work with many suppliers. Many SMB's skip the generation of purchase orders and rely on historical context or gut feeling to track purchases because of the difficulties associated with manually managing purchase orders.

Managing accounts payable manually is a slow and inefficient process which brings us to the last challenge the average SMB faces – not using the right tool. The right tools are digital solutions that utilize automation, streamline calculations, and centralize your accounts payable data in a single platform.

The 5 Ways TROY FlexPay Simplifies Accounts Payable

TROY FlexPay is an innovative and easy to use solution for small businesses looking to streamline their accounts payable. With TROY FlexPay accounts payable automation, tracking purchase orders and invoices and manual data entry is no longer a worry. By integrating TROY FlexPay with your vendor data within QuickBooks, you can start paying vendors how you want just from one platform. TROY FlexPay gives you the capability to choose to settle your bills by ACH, digital checks, printed checks, or a check fulfillment service.

TROY FlexPay has many benefits, but there are 5 core benefits worth pointing out from the get-go.

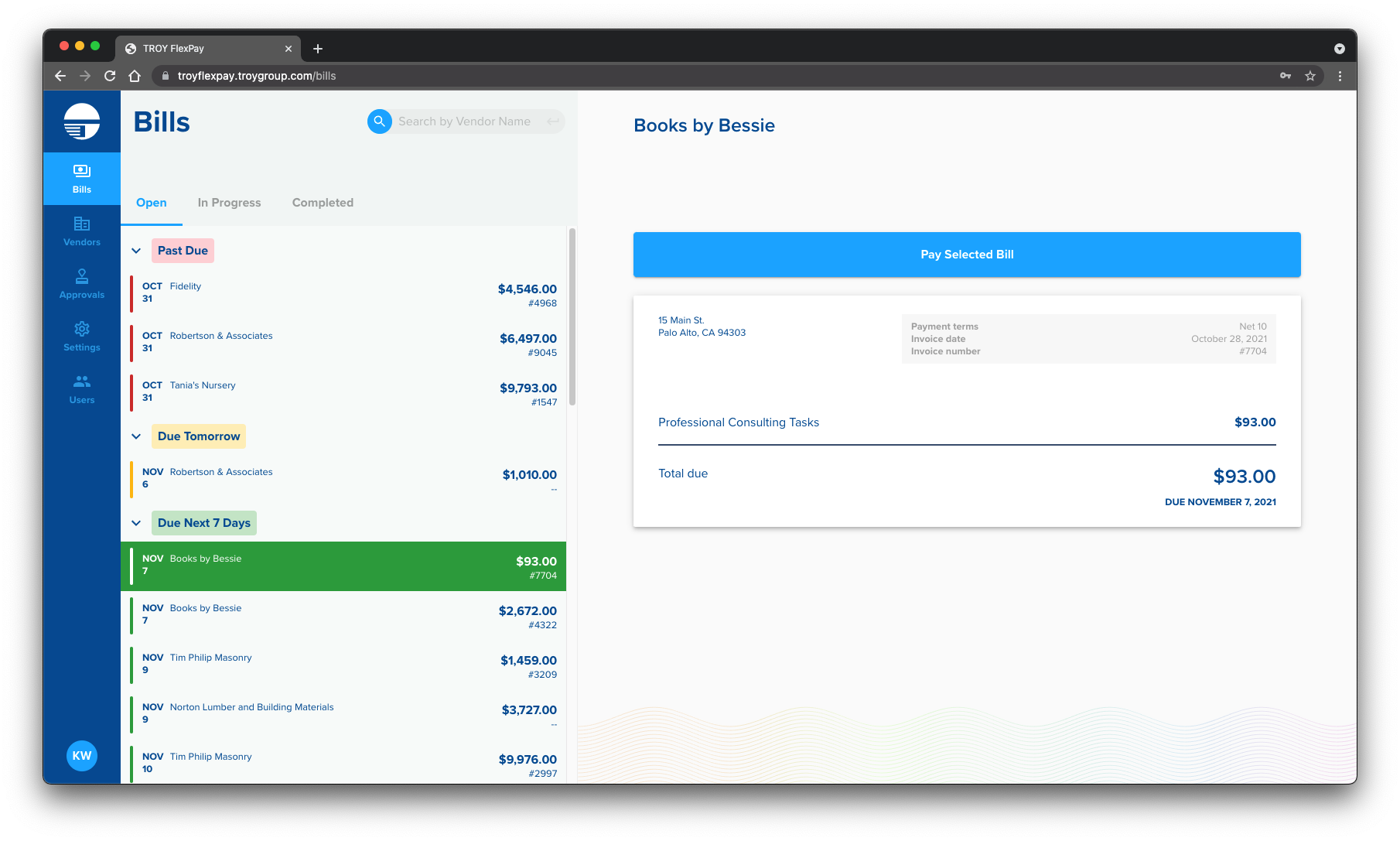

Centralize the Process: Bringing all invoices and accounts payable data into a central platform or one plane where a simple glance gives you insight into tens of invoices and payment agreements, instantly simplifies the process. TROY FlexPay gives you a centralized display that enables you to view your company’s invoices, approval requirements, and payment instructions. This ensures you always have full control of your accounts payable data and process. Hence, eliminating some of the challenges associated with keeping track of invoices and purchase orders.

Automate Data Entry: One of the major benefits TROY FlexPay brings to your table is the use of automation to manage future data entries, purchase orders, and calculations. Leveraging automation solves the challenges SMBs face with the accounts payable process such as the labor-intensive and time-consuming activities associated with manual data entry. Automation also reduces the probability of calculating errors due to manual data entry and account reconciliation. TROY FlexPay takes automation up a notch by providing you with automated reminders to ensure you never forget a payment, purchase order, or agreement. Thus, ensuring you fulfil your agreements and keep your supplier-recipient relationship positive.

Detailed Reporting: TROY FlexPay enables you to keep accurate records of all accounts payable data. Access to both current and historical data provides your company with a basis for analyzing its transactions and forecasting future purchases. Detailed reporting also ensures accountability within the company through access to transactional data from specific dates, who authorized specific payments, and to which vendors. The transparency attached to detailed reporting increases your audit readiness and eliminates errors.

Vendor Management: Building a great, credit-worthy relationship with your suppliers ensures the raw materials or items needed to keep your business profitable flow continuously. TROY FlexPay ensures you can access vendor details in real-time, adjust payment preferences, communicate these preferences to the vendor, and streamline the entire payment process. Hence, with TROY FlexPay, you can convince vendors that sending digital invoices through the right channels ensures they get paid on time and according to prior agreements.

Manage Check Payments: One of TROY FlexPay’s innovative features is its ability to support your check payment choices. With the application, you can choose to create either digital or physical checks depending on your vendor’s requirements. The check payment flexibility the app provides is a unique feature that elevates it above the competition. TROY Group also supports your check payment choice by providing you with the option to outsource the creation of secure checks to us. With over 60 years of securing the check payment industry, you can be assured that your checks will be secure from fraud using cutting-edge technologies.

TROY FlexPay and QuickBooks

TROY FlexPay integrates seamlessly with QuickBooks Desktop and Online solutions to secure your payment options. The centralization, automation, and synchronization with QuickBooks ensures you can eliminate approximately 60% of the time spent managing account payable processes. Introduce automation and digitalization to your accounts payable processes by signing up today. For your ultimate convenience, TROY FlexPay is available on the QuickBooks app store.

For more information on, visit the dedicated FlexPay website here.

Related Posts

Bank Tellers Are Going Away. What's Next?

The landscape of banking has undergone significant transformation. One notable shift is the steady decline in bank teller jobs, a trend driven by technological advancements,..

Platform Revolution: 4th Generation of Core Banking

The 4th generation of core banking has arrived, bringing with it a platform revolution that is reshaping the banking industry. This transformation heralds the transition from..

5 ATM Features Banks Need in a Cashless Society

As contactless payments, digital wallets, and online banking increasingly become the norm, the reliance on cash is steadily diminishing. This shift towards a cashless society is..

Leave a Reply