Pre-Printed vs. Blank Check Stock - Know The Difference

In the realm of financial transactions in business large and small, the humble paper check continues to play a significant role despite the digital age we live in. The choice between using blank check stock and pre-printed check stock might seem like a minor decision, but it can have profound implications for security and flexibility. In this blog post, we'll delve into the advantages of blank check stock and why it stands as the better choice when it comes to mitigating fraud risks.

What's the difference between blank check stock and pre-printed check stock?

It might seem obvious what the differences are just based on the names of both types of check stock, but they may surprise you. Understanding the distinction is crucial to deciding which to use. Let's dive into both:

What is pre-printed check stock?

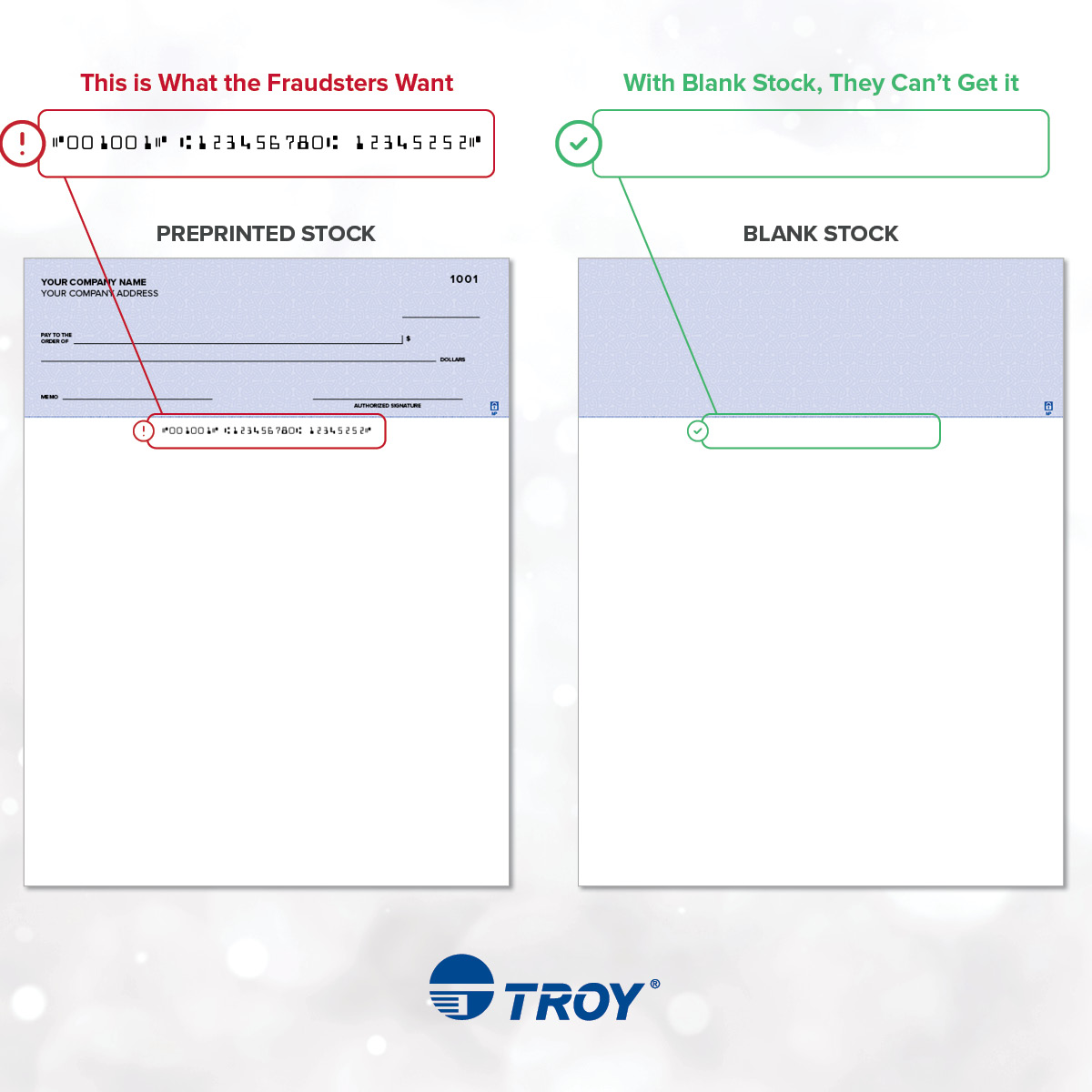

Pre-printed check stock comes with all the necessary information already printed on it, including the bank account number, routing number, and possibly the payee's name.

What is blank check stock?

Blank check stock lacks pre-printed account information. Users need to input the necessary details using check writing software or a printer designed for this purpose.

Now, using pre-printed check stock may sound commonplace and more convenient. It doesn’t require extra printing, hardware, or the knowledge needed to use such tools. Any individual who writes checks regularly wouldn’t want to have to print all their account information before writing a check, and large businesses that process thousands of checks a month, or even a day, might even see the benefits of using pre-printed stock -- but both parties should be able to identify the elephant in the room. Can you guess what it is?

You got it! Pre-printed checks are essentially a goldmine for fraudsters. If a fraudster gets their hands on a pre-printed check, they have access to the account and routing numbers, and the payee's name without having to do any research. They can also use tactics such as check washing to change any information to benefit them, or go as far as creating counterfeit checks.

While check washing or counterfeiting may sound like schemes that our current society has moved past, think again. Check washing has been making a comeback in recent years, simply because it’s a relied-upon method of fraud that most companies and people don’t anticipate. ABC reported on check washing schemes just in October 2022. While the report focused mainly on fraud against individuals, companies are at an even higher risk because of their large portfolios, lengthy processes, and bank accounts, -- where as much as $5,000 can be small potatoes.

What makes blank check stock the better option?

Blank check stock has a huge advantage over pre-printed check stock. Not only does it automatically put security measures in place by taking exposed account information out of the conversation altogether, but it also has other benefits including re-usability and cost-effectiveness:

- Reduced Risk of Fraud: Unlike pre-printed stock, blank check paper requires the user to input the recipient's name and the amount, making it harder for fraudsters to execute unauthorized transactions.

- Flexibility: Businesses have to change account information for themselves and for clients frequently. Blank checks accommodate these changes effortlessly, avoiding the need to dispose of outdated pre-printed checks.

- Cost-Effectiveness: Pre-printed checks often require bulk orders, which can lead to wastage if not all checks are used. Blank check stock eliminates this waste by allowing you to print checks as needed, saving you money on check paper.

TROY's Product Line of Defense

At TROY, we recognize the importance of blank check stock, but we also recognize that it is only the first step in the process of setting your business up for a secure future. The benefits are there, but what comes after? Can you still be frauded even after you implement blank check stock? The short answer is yes, but TROY has a product line of total defense when paired together.

- Blank Check Stock: TROY's line of blank check stock offers the latest technology to prevent fraudulent copying, alteration and counterfeiting while complying with the financial services industry requirements for check imaging and clearing.

- MICR Toner Secure: TROY's MICR Toner Secure takes standard MICR ink and adds a special, patented security feature: a red dye that releases whenever check washing is attempted, alerting the banks of check fraud immediately.

- Locking Trays: A printer with a locking tray is leagues above any standard printer. Not only does this add extra protection against theft of both pre-printed or blank stock, but it reduces the chain of custody protocols and saves money in the long run.

In the age of digital finance, the paper check remains a vital instrument for transactions. Opting for blank check stock over pre-printed check stock is a prudent choice, primarily due to its superior security features and flexibility. By minimizing the risk of fraud, reducing personal information exposure, and providing customization options, blank check stock empowers businesses and individuals to maintain greater control over their financial transactions while safeguarding their resources.

Related Posts

Bank Tellers Are Going Away. What's Next?

The landscape of banking has undergone significant transformation. One notable shift is the steady decline in bank teller jobs, a trend driven by technological advancements,..

Platform Revolution: 4th Generation of Core Banking

The 4th generation of core banking has arrived, bringing with it a platform revolution that is reshaping the banking industry. This transformation heralds the transition from..

5 ATM Features Banks Need in a Cashless Society

As contactless payments, digital wallets, and online banking increasingly become the norm, the reliance on cash is steadily diminishing. This shift towards a cashless society is..

Leave a Reply