Check Printing Software: What Do You Need? - Payments Software

Let’s say your organization is looking to print checks in house and on demand. Understandably, you have questions. What equipment do you need? Are there standards that you need to follow? And even if you have a dedicated MICR printer and you’re using MICR toner – you can’t print checks without check printing software.

Using a check printing software is the first step to ensuring that your printed checks follow ABA and ANSI standards for check printing. And with the right features, this software can provide you with tools to keep you safe from fraud.

Key Features of a Check Printing Software Solution

Whether you are using pre printed or blank check stock, check printing software enables you to streamline the issuing of checks. This is because the software allows the users to fill in the amount, payee, and other key details. In some instances, even the payer’s signature. This frees up time for authorized signers to focus on tasks most important to your business.

And if you’re using blank check stock, a check printing software that grants the ability to place the MICR line is essential.

The MICR line is the series of numbers and characters printed at the bottom of the check. That includes all the check’s essential information – like the check, account, and routing numbers. This core characteristic of the check allows data to be electronically captured. Because of the strict standards to ensure accurate high-speed scanning, placement and character integrity are vital. Variances in these characteristics can lead to check rejection, lost time, and fees.

If your organization has multiple accounts, you’ll want to find check printing software that gives you the ability to manage them from a centralized system. This allows you to drop pre printed stock and put in place blank check stock. By doing so, you can increase efficiency and decrease the cost of your check printing process.

Digital Signatures

When it comes to printing your own checks, it’s a good idea to look for one that enables you to insert digital signatures.

By using digital signatures with your check printing software, you can increase the efficiency of your process. You can easily and securely apply signatures to all the checks you are printing. And if employees are working from home, it eliminates the burden of running to the office or coordinating to meet up with the CFO to hand sign checks.

Security

You’ll also want to make sure your software has an audit trail and reporting functions. This is going to help you keep track of all the checks you are printing and who is receiving them. Audit features help protect your organization from internal fraud threats, including accounts payable fraud.

Strong auditing and reporting features in your check printing software can be helpful in creating user-defined reports. This provides your organization with a strong checks and balances system.

Another thing to consider is finding a check printing software that supports Positive Pay. This cash management system deters fraud by matching the dollar amount, check number, and account number for each payment against issued checks. Businesses must send a list to the bank for Positive Pay to work.

By utilizing software that supports Positive Pay, businesses can easily maintain, export, and send this file to the bank.

On-Premise or Cloud-Based Check Printing Software?

With any software these days, you’ll have the option of using either an on-premise or cloud-based solution. Both offer advantages, so you’ll have to decide which type best fits the needs of your organization.

The biggest advantage of using an on-premise check printing software is that data locally stored. So your organization will have full control over who has access to the software and its financial records. You also do not have to worry about losing access or use of the software if any network issues occur.

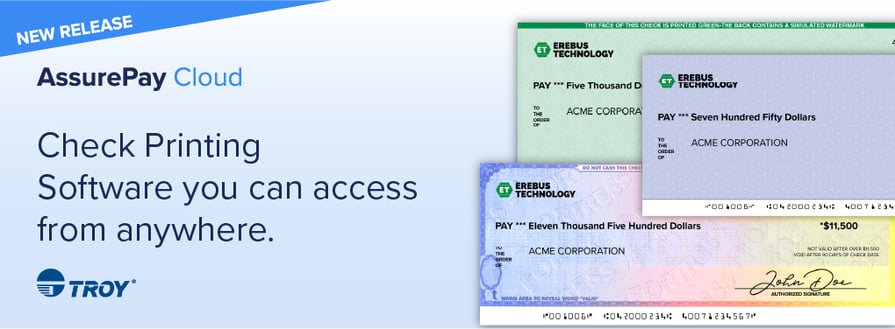

Cloud-based software enables users to securely access the software via browser from anywhere. Users can view and authorize check batches on the go from any network- or internet-connected desktop, tablet, or mobile device.

Organizations can also reduce their IT costs by minimizing (or eliminating) the need to maintain software installed on the servers. Also, updates to the web application are automatically installed, This limits or eliminates downtime, outages, or interruptions to business.

One Part of a Total Check Printing Process

Check fraud is the most dominant form of payment fraud, above credit card fraud, ACH fraud and wire fraud. A full 74 percent of companies experienced actual or attempted check fraud in 2019, an increase from 70% the year prior. Fraud has been decreasing over the last few years. Yet, in times of change and unrest, like we’re experiencing now, fraudsters take advantage of an organization’s turmoil.

That’s why it is important to have a secure check printing process in place. While a check writing software is a good first step, you should also be using a MICR printer, MICR toner, and blank check stock as well. Implementing all these components into a check printing workflow gives you an end-to-end, secure check printing solution.

Ready to Get Started?

Let us help you. If you’re interested in learning about TROY’s AssurePay check writing software, or you need more information, the MICR specialists at TROY can help you. Contact us by calling 304-232-0899 or email Secure@TROYGroup.com.